Will My Homeowner’s Insurance Company Help Pay For Tree Removal?

https://docs.google.com/spreadsheets/d/1CjJ5AyPaHRlEaYj_gWbOFusRegbjJdZBq70D_0H60_I/edit?usp=sharing

https://docs.google.com/spreadsheets/d/1KhaTrSjG-9Jd2cglfoVvpFgKSq3Yhn24OAr3jjB-PPc/edit?usp=sharing

Name: Truco Services, Inc.

Address: 4640 Commerce Drive, Murray, UT 84107 USA

Phone: (801) 466-8044

Website: https://trucoservices.com

Facebook: https://www.facebook.com/TruCoServices/

Youtube: https://www.youtube.com/channel/UCIlpSGk3aKxr8qV6iYIsCYw

Map: https://maps.app.goo.gl/Cyhddr5ix3snqgPL8

Hours of Operation: Monday – Friday: 8:00am – 5:00pm; Saturday – Sunday: Closed

Categories: Tree Service, Tree Removal, Tree Trimming, Arborist, Stump Grinding, Tree Care, Tree Pruning, Tree Cutting, Tree Surgeon, Tree Felling, Tree Maintenance, Tree Company, Tree Experts, Emergency Tree Services, Tree Planting, Tree Diagnostics, Tree Inspection, Tree Preservation, Tree Hazard Assessment, Tree Consultations, Tree Climbing, Tree Cabling, Tree Bracing, Tree Transplanting, Root Pruning, Tree Mulching, Tree Health, Tree Disease, Tree Pests, Tree Fertilization, Tree Spraying, Tree Irrigation, Tree Lightning Protection, Tree Support Systems, Tree Identification, Land Clearing, Lot Clearing, Deadwood Removal, Hazard Tree Removal, Brush Clearing, Firewood, Wood Chips, Tree Recycling, Storm Damage, Hurricane Cleanup, Landscape Design, Landscaping, Lawn Care, Garden Design, Garden Maintenance, Hardscaping, Softscaping, Landscape Construction, Retaining Walls, Patios, Walkways, Driveways, Pavers, Flagstone, Rock Gardens, Water Features, Ponds, Fountains, Outdoor Lighting, Irrigation Systems, Drainage Solutions, Outdoor Kitchens, Fire Pits, Pergolas, Gazebos, Green Roofs, Plant Installations, Season Color Displays, Lawn Mowing, Lawn Edging, Landscape Architecture, Site Analysis, Master Planning, Grading And Drainage, Planting Design, Hardscape Design, Project Management, Landscape Engineering, Sustainable Design, Ecological Restoration, Historic Preservation, Landscape Construction Administration, Site Supervision, Construction Documentation, Landscape Construction, Site Preparation, Grading, Excavation, Foundation Work, Stonework, Concrete, Masonry, Carpentry, Decking, Fencing, Gates, Commercial Tree Care, Commercial Tree Maintenance, Commercial Tree Removal, Commercial Tree Trimming, Commercial Landscaping, Commercial Lawn Care, Commercial Tree Planting, Commercial Irrigation Systems, Commercial Tree Health, Commercial Tree Disease, Commercial Tree Pests, Commercial Tree Fertilization, Commercial Tree Spraying, Commercial Tree Pruning, Commercial Tree Cutting, Commercial Tree Surgeon, Commercial Tree Experts, Commercial Emergency Tree Services, Commercial Tree Consultations, Commercial Tree Inspections, Commercial Lot Clearing, Commercial Land Clearing, Commercial Deadwood Removal, Commercial Brush Clearing, Commercial Firewood, Commercial Wood Chips, Commercial Tree Recycling, etc.

https://truetreeservices.com/the-science-behind-how-trees-regulate-climate/

What To Look For In Tree Removal Service

https://docs.google.com/spreadsheets/d/1tnRICo7gOurKvYcMyeQP0bG5ETbSCMOmmzjaiR_D5-I/edit?usp=sharing

https://docs.google.com/spreadsheets/d/1HrZUR1_pmclcHtkEsluJhnEHuREcR1DgoZFFRafhd44/edit?usp=sharing

#TreeRemoval

#TrucoServices

#TrucoLandscaping

Will My Homeowner’s Insurance Company Help Pay For Tree Removal?

Homeowners often face unexpected challenges, and one of those can be the need for tree removal. Whether due to age, disease, or a damaging storm, a fallen or problematic tree can create not only a safety hazard but also a substantial expense. In this moment of uncertainty, many ask themselves, “Will my homeowner’s insurance company help pay for tree removal?” The answer is not straightforward, but understanding your policy can illuminate your options.

First, it’s essential to know that homeowner’s insurance typically covers specific types of tree removal under certain circumstances. Here are the primary situations in which your insurance may help:

- Damage to a Structure: If a tree falls on your house, garage, or any other insured structure, your homeowner’s insurance usually covers the cost of removal. This can include any damage that the tree causes to the structure.

- Fallen Trees due to a Covered Peril: If a storm or another covered peril (like lightning) causes a tree on your property to fall, insurance might help cover removal costs.

- Emergency Situations: If a tree poses an immediate threat to your home or safety, your insurer may agree to cover removal costs, depending on the circumstances.

However, not all tree removal situations fall within the coverage. Here are some circumstances that typically will not be covered:

- General Maintenance: If the tree is simply a nuisance or needs to be removed as part of routine yard maintenance, your insurance policy likely won’t cover the costs.

- Non-Damaged Trees: If a tree has not fallen or damaged anything but you want it removed, you will most likely need to pay out of pocket.

- Pre-existing Conditions: If the tree is dead or diseased, and it falls before a storm or hazard, insurance may not cover the removal since it was in a weakened state beforehand.

Understanding your specific homeowner’s policy is crucial. Here are a few steps you can take:

-

- Review Your Policy: Look for sections related to tree removal, damage from falling objects, and covered perils. Familiarize yourself with the limits of your coverage.

- Contact Your Insurer: If you’re unclear about coverage, reach out to your insurance agent for detailed explanations. They can clarify what is covered and what is not.

- Document Everything: If a tree falls due to a covered peril, document the damage with photographs. This will help when submitting a claim.

- File a Claim: If applicable, file a claim as soon as possible. Keep in mind that your insurer may require an inspection before approving any costs.

When considering tree removal, also think about the cost implications. Tree removal can range widely depending on the tree’s size, location, and whether it’s in a risky area. Costs can be anywhere from $200 for smaller trees to $1,500 or more for larger or hazardous tree removals.

Insurance claims can sometimes be a slow process, so if you need urgent tree removal services, you may have to pay out of pocket initially. In this case, ensure you keep detailed records of the expenses incurred, as you may be able to recoup some of those costs later through your insurance company.

Ultimately, whether your homeowner’s insurance will help pay for tree removal largely depends on your specific circumstances. If a tree removal situation occurs, always refer to your policy guidelines, communicate openly with your insurance company, and document any necessary details thoroughly. By being informed and proactive, you can navigate this difficult situation with more confidence.

While homeowner’s insurance can assist with tree removal in particular conditions, understanding your policy and how it relates to tree damage is critical in making informed decisions. Being prepared today can save you time and money tomorrow, easing the burden of unexpected expenses related to tree removal.

Understanding Homeowner’s Insurance Policies and Coverage Limits

When you purchase a homeowner’s insurance policy, you’re essentially investing in peace of mind. Understanding how these policies work and what they cover is crucial. Homeowner’s insurance provides financial protection against a variety of risks, including damage to your home and liability for accidents that occur on your property. However, the details can often be complex and confusing.

Most homeowner’s insurance policies typically fall under two main categories: dwelling coverage and personal property coverage. Dwelling coverage protects the structure of your home, while personal property coverage safeguards your belongings inside the home. Together, these two coverages form the foundation of most policies.

4640 Commerce Drive

Murray UT 84107 USA

(801) 466-8044

Permanent Holiday Lighting close to Layton UT

Additionally, many policies include liability coverage. This protects you if someone gets injured on your property and decides to sue. Liability coverage is vital for safeguarding your financial stability in case of unexpected events. It’s important to check the limits of this coverage, as it can vary significantly from one policy to another.

There are several standard types of coverage options that you should be aware of:

- Dwelling Coverage: This covers the home itself, including the roof, walls, and built-in appliances. It typically pays to repair or rebuild your home after a covered loss.

- Personal Property Coverage: This part of the policy insures your personal items, like furniture and electronics, against theft or damage.

- Liability Coverage: Helps pay for legal expenses and damages when someone is injured on your property.

- Loss of Use Coverage: If your home becomes uninhabitable due to damage, this covers additional living expenses, like hotel stays, while repairs are being made.

- Other Structures Coverage: This protects structures not attached to your home, such as sheds or fences.

Understanding your policy means being aware of coverage limits, which can vary widely. Each type of coverage has its own limit, which can impact how much you can claim in the event of a loss. For instance, if your dwelling coverage limit is $250,000, that’s the maximum amount your insurer will pay for damages to your home structure. If the cost to rebuild your home exceeds this limit, you could face significant out-of-pocket expenses.

Additionally, be mindful of deductibles. A deductible is the amount of money you must pay out of pocket before your coverage kicks in. Higher deductibles can lower your monthly premium but will cost you more during a claim. Finding the right balance is key.

It’s also essential to know what is not covered under standard homeowner’s insurance. Common exclusions often include:

- Flood Damage: Most policies do not cover damage caused by floods, requiring separate flood insurance.

- Earthquake Damage: Similar to flood insurance, you may need additional coverage for earthquakes.

- Negligence: If damage occurs due to lack of maintenance, your claim may be denied.

Once you have a grasp on what’s covered, evaluating the adequacy of your coverage limits is crucial. Regularly reassess your policy as the value of your home and personal property may change over time. For instance, if you remodel your kitchen or buy expensive electronics, your current limits may no longer suffice.

Reviewing your policy annually with your insurance agent can ensure your coverage limits align with your needs. During this review, inquire about available endorsements or riders that can enhance your coverage. For example, a replacement cost endorsement can provide additional financial protection, ensuring you get paid for the full replacement cost of a damaged item, rather than the depreciated value.

Understanding homeowner’s insurance policies and coverage limits is a key component in safeguarding your investment. By familiarizing yourself with the various coverages and their limits, you can better prepare for any unforeseen circumstances. Take the time to educate yourself about your policy and consult your insurance provider if you have questions. This proactive approach can help you secure the peace of mind that comes with owning a home.

The Factors That Influence Tree Removal Costs

When considering tree removal, homeowners often wonder about the costs involved. Several factors can influence how much you’ll pay for this service. Understanding these factors can help you budget wisely and make informed decisions.

4640 Commerce Drive

Murray UT 84107 USA

(801) 466-8044

Permanent Holiday Lighting close to Layton UT

Size of the Tree

The size of the tree is one of the primary factors affecting removal costs. Smaller trees generally cost less to remove than larger ones. Here’s a breakdown:

- Small Trees: Typically under 30 feet tall, these trees may range from $150 to $300 for removal.

- Medium Trees: Ranging from 30 to 60 feet, expect to pay between $300 and $700.

- Tall Trees: Over 60 feet, removal can cost anywhere from $700 to $1,500 or more.

Tree Condition

The condition of the tree plays a critical role in determining the cost. A healthy tree is easier and safer to remove compared to a dead or damaged tree. Factors to consider include:

- Healthy Trees: More straightforward to remove; these may fall on the lower end of the price range.

- Dead Trees: Often require additional equipment and caution, leading to higher costs.

- Hazardous Trees: If a tree leans or poses a risk of falling, costs can increase significantly due to safety measures.

Location of the Tree

Where the tree is located on your property can also affect the price. Consider these aspects:

- Proximity to Buildings: Trees near structures can complicate removal, requiring special techniques to prevent damage.

- Access: If the tree is hard to reach, such as in a tight space or along a narrow pathway, additional equipment may be necessary.

- Surrounding Structures: Trees close to power lines or fences may incur extra costs due to the need for careful handling.

Removal Method

The method used for tree removal also impacts the price. Some techniques include:

- Basic Removal: Cutting the tree down in sections is the most straightforward method and generally costs less.

- Crane Removal: For very tall or complex trees, using a crane may be necessary, significantly raising the cost.

- Stump Grinding: Removing the stump after the tree is down can add to your overall expenses.

Debris Disposal

After removal, you will need to consider how the debris will be handled. Most tree service companies offer debris disposal, but it may or may not be included in the initial estimate. Here’s what to keep in mind:

- Included in Cost: Some companies will take care of everything for you, keeping the total price straightforward.

- Separate Charges: Others may charge an additional fee for hauling away logs, branches, and leaves.

Seasonal Considerations

The time of year can impact tree removal costs as well. During peak seasons, usually spring and summer, demand for tree services can drive prices up. Conversely, during fall or winter, you might find reduced prices as companies look to fill their schedules. Always check with your service provider about seasonal discounts or promotions.

Additional Factors

Several other factors might influence tree removal costs, including:

- Permits: In some areas, you may need permits for tree removal, adding to the overall cost.

- Insurance: Check if your homeowner’s insurance covers tree removal, especially for trees that fall or pose hazards.

- Experience of Service Provider: Highly-rated companies with good reviews may charge more due to their reputation and expertise.

By taking all these factors into account, you can make a more informed decision about tree removal on your property. Begin by getting multiple quotes from service providers to understand the range of costs and options available to you. Always choose a reputable service to ensure safety and quality work. Being informed will help you navigate the process smoothly.

Alternatives to Insurance Claims for Tree Removal Expenses

When unexpected tree removal becomes necessary, many homeowners instinctively consider filing an insurance claim. However, there are situations where this may not be the best route to take. You might wonder about alternatives to insurance claims for tree removal expenses that can help you secure the funds you need to address the problem promptly.

4640 Commerce Drive

Murray UT 84107 USA

(801) 466-8044

Permanent Holiday Lighting close to Layton UT

Understanding Your Insurance Policy

Before exploring alternatives, it’s essential to understand the intricacies of your homeowner’s insurance policy. Coverage can vary significantly between providers. Sometimes, tree removal may only be covered if the tree has fallen on your home, garage, or another property structure. Therefore, familiarize yourself with your specific policy to determine if a claim would be beneficial.

Cash Savings

If you find yourself needing to remove a tree, one of the most straightforward options is to utilize your savings. This approach allows you to maintain your insurance premium rates by avoiding claims, which can lead to higher future premiums. Consider redirecting funds from other expenditures or setting aside a specific amount each month to build a tree removal fund.

Community Assistance Programs

Investigate local community programs or organizations that provide services for tree removal, especially if the tree poses a hazard due to storm damage or decay. Some municipalities offer assistance or grants for homeowners dealing with hazardous trees. Reach out to your local government office or look up non-profit organizations in your area.

Negotiating with Tree Removal Companies

Many tree removal companies are willing to work with you on pricing. Here are some strategies:

- Ask for Multiple Quotes: Comparing quotes from several companies can help you find the best price for your situation.

- Inquire About Discounts: Many companies offer discounts for seniors, veterans, or bulk services (like removing multiple trees).

- Negotiate Payment Plans: Some firms may allow you to break up the total cost into manageable payments instead of paying all at once.

Personal Loans

If cash savings are insufficient, consider applying for a personal loan. Many lenders offer loans specifically for home repairs and maintenance. Look for options with low-interest rates and favorable repayment terms. However, be cautious and ensure this route aligns with your financial situation and long-term goals.

Crowdfunding and Community Support

In recent years, crowdfunding has emerged as a practical way to raise funds for specific projects or expenses, including tree removal. You could create a campaign on platforms like GoFundMe, explaining your situation and asking friends, family, and community members for help. Sharing the campaign on social media can amplify your reach.

Bartering Services

Consider bartering if you have a skill or service to offer. Many people in your community might be willing to remove your tree in exchange for some service you can provide. This could include anything from gardening services, handyman work, or freelance graphic design. An agreement that works for both parties can often save cash while fostering neighborly ties.

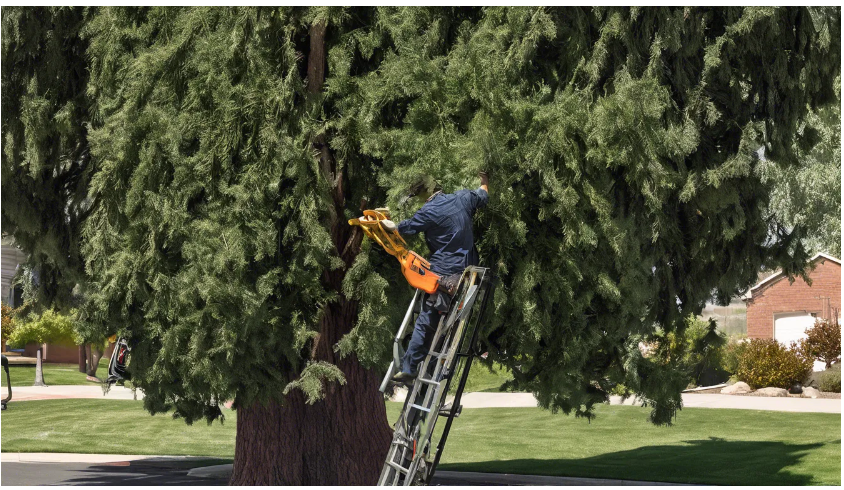

DIY Tree Removal

For smaller trees, you might consider a do-it-yourself approach to avoid hefty fees. Ensure you have the proper tools and safety gear before attempting this. Keep in mind that removing larger or more dangerous trees may not be advisable without professionals due to safety risks.

4640 Commerce Drive

Murray UT 84107 USA

(801) 466-8044

Permanent Holiday Lighting close to Layton UT

Prevention and Maintenance

Looking ahead, regular maintenance can prevent tree issues from escalating. Here are some steps to consider:

- Routine Inspections: Keep an eye on the health of your trees. Early detection of problems can prevent costly removals later.

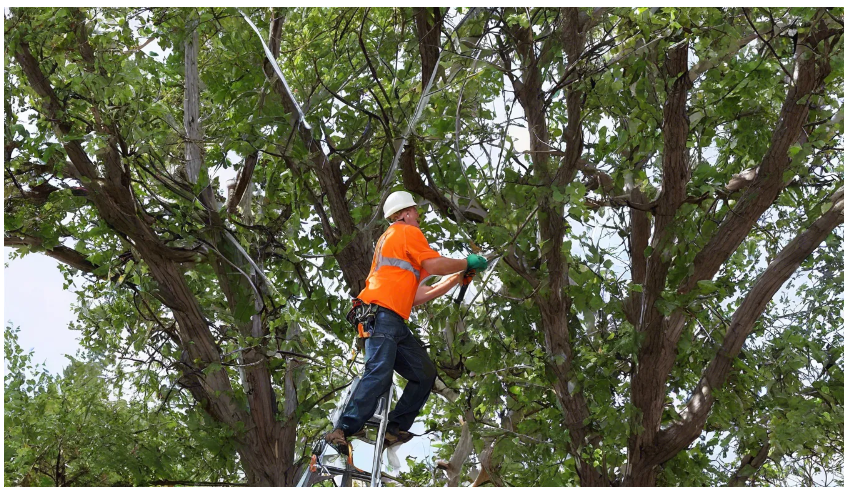

- Trimming and Pruning: Regular trimming can help maintain tree strength and minimize the likelihood of trees becoming hazards.

- Consulting With Arborists: Hiring an arborist for periodic evaluations can save you money in the long run and prolong the life of your trees.

Exploring these alternatives can provide relief without the potential drawbacks of filing an insurance claim. By being proactive and considering your options, you can address tree removal expenses in a way that is financially sustainable and beneficial for your home.

Preparing for a Tree Removal: Steps to Take Before Contacting Your Insurance Company

Removing a tree from your property can be a big task, both emotionally and financially. If you’re contemplating tree removal and are unsure whether your homeowner’s insurance will cover it, there are several steps you should take before reaching out to your insurance company. Here’s how to prepare effectively.

First, assess the situation carefully. Take a close look at the tree that needs removal. Determine its location and condition. Is it dead, dying, or posing a risk to your home or other structures? Document any visible damage, such as broken branches or signs of disease. This will help clarify the urgency of the tree removal when discussing the situation with your insurance provider.

Next, gather photographs of the tree and the surrounding area. Capture images from multiple angles and include the proximity to your home or other buildings. This visual evidence will not only support your case for insurance coverage but also give your insurance adjuster a clear understanding of the situation.

After taking pictures, look at your homeowner’s insurance policy. Review the sections related to tree removal, particularly those involving falling trees, property damage, or potential hazards. Understand what your policy covers. Typically, homeowners insurance might help pay for tree removal if the tree damages your home or another insured structure, but it’s important to know the specifics.

Here is a quick checklist to ensure you are well-prepared:

- Assess the condition of the tree.

- Document any damage to your property.

- Take clear photographs from various angles.

- Review your homeowner’s insurance policy for tree removal clauses.

- Check for local ordinances regarding tree removal.

Next, research local ordinances. Some municipalities have strict regulations on tree removal. Knowing these rules can save you time and prevent potential fines. Your local government website or a quick phone call to the city office might provide the information you need.

It’s also wise to obtain estimates from tree removal services. Reach out to several reputable companies in your area to discuss your needs. Ask for both written estimates and verbal endorsements. Having multiple quotes will give you a clearer picture of potential costs and can serve as another piece of documentation to present to your insurance company.

4640 Commerce Drive

Murray UT 84107 USA

(801) 466-8044

Permanent Holiday Lighting close to Layton UT

When discussing the tree’s condition with professionals, inquire about any risks involved in the removal process. Understanding these risks will help you present a more compelling case to your insurance company. It can also help you gauge the urgency of the situation if the professionals indicate that the tree poses an immediate danger.

Prepare to communicate clearly with your insurance company. Before contacting them, outline key points you want to discuss. Mention the tree’s condition, any damage it may have already caused, and include the documented evidence you’ve gathered. Be ready to explain why removal is necessary and why you believe insurance should cover the costs.

Additionally, keep in mind that some insurance companies may have specific procedures to follow for claims. Ensure you know whether you need to file a claim first or seek pre-approval for tree removal. Knowing these details can help speed things along.

Keep all correspondence organized. Whether it’s emails with your insurance company or paperwork from the tree removal service, having everything in one place will make communication smoother. This organization shows your insurance provider that you are serious about your claim.

Understanding these steps can ease the process if you find yourself faced with the challenging task of tree removal. By assessing the situation, gathering necessary documentation, and clearly communicating with your insurance, you position yourself for a better chance at receiving financial assistance. Taking these proactive measures can provide peace of mind as you navigate the complexities of tree removal.

Key Takeaway:

When considering whether your homeowner’s insurance company will help pay for tree removal, several important aspects come into play. Firstly, it is crucial to understand your homeowner’s insurance policy and its coverage limits. Many policies do cover damages caused by fallen trees, but they often have specific conditions. Generally, if a tree falls on your home or causes damage to other structures on your property, your insurance may step in to cover those repair costs. However, if a tree simply falls in your yard without causing any damage, you may be left to cover the removal expenses yourself.

The costs associated with tree removal can vary greatly depending on several factors. These include the size and condition of the tree, its location, and any potential hazards surrounding it. For instance, a tree close to power lines or a structure may require more specialized services, which can increase the overall price significantly. Being informed about these cost factors can help you prepare for what may be a significant expense.

If your insurance coverage falls short or doesn’t address tree removal, there are alternatives you can consider. Researching local assistance programs or checking for municipal services that offer tree removal, especially in the wake of severe weather events, can provide options. Additionally, you may want to explore payment plans or financing options with private tree services that can make the process more manageable.

Before you contact your insurance company, preparing a few key steps can streamline the process. Documenting the tree’s condition, taking photos, and noting how it might affect your property will create a strong case when submitting your claim. Understanding your policy provides clarity about what’s covered, helping you to advocate effectively for the financial assistance you may need.

4640 Commerce Drive

Murray UT 84107 USA

(801) 466-8044

Permanent Holiday Lighting close to Layton UT

Ultimately, being informed and prepared is key to navigating the complexities of home insurance when it comes to tree removal. Always read your policy to understand your coverage and what expenses are your responsibility.

Conclusion

Navigating the complexities of tree removal and homeowner’s insurance can feel overwhelming, but understanding your policy is crucial. Homeowner’s insurance may cover tree removal costs, especially if the tree poses a risk to your property or has already caused damage. However, coverage can vary widely based on your specific policy and its limits.

Factors such as the size of the tree, its location, and any damage caused to your home will influence the overall removal costs. Knowing these details can help you prepare for potential expenses and understand what financial assistance you may receive from your insurer.

If your claim is denied or if the costs exceed your coverage limits, consider alternative ways to handle tree removal. Options like personal funds, payment plans, or even local assistance programs might be available to help.

Before making that call to your insurance company, take steps to document the situation thoroughly. Photographs of the tree, notes on any existing damages, and details about the removal process can strengthen your claim and provide clarity.

Being informed empowers you to make better decisions when dealing with tree removal and insurance claims. Make sure to review your policy, understand the coverage, and prepare for the claims process to alleviate the stress of tree-related expenses. By taking these steps, you’ll be better positioned to navigate any challenges that arise and ensure your property remains safe and secure.

If you need a tree service in Utah, you can call:

Truco Services, Inc.

4640 Commerce Drive

Murray, Utah 84107

(801) 466-8044

https://truetreeservices.com/